We Turn Energy Into Intelligence,

And Intelligence Into Sound MoneyWe Turn Energy Into Intelligence,

And Intelligence Into Sound Money

We Turn Energy Into Intelligence,

And Intelligence Into Sound Money

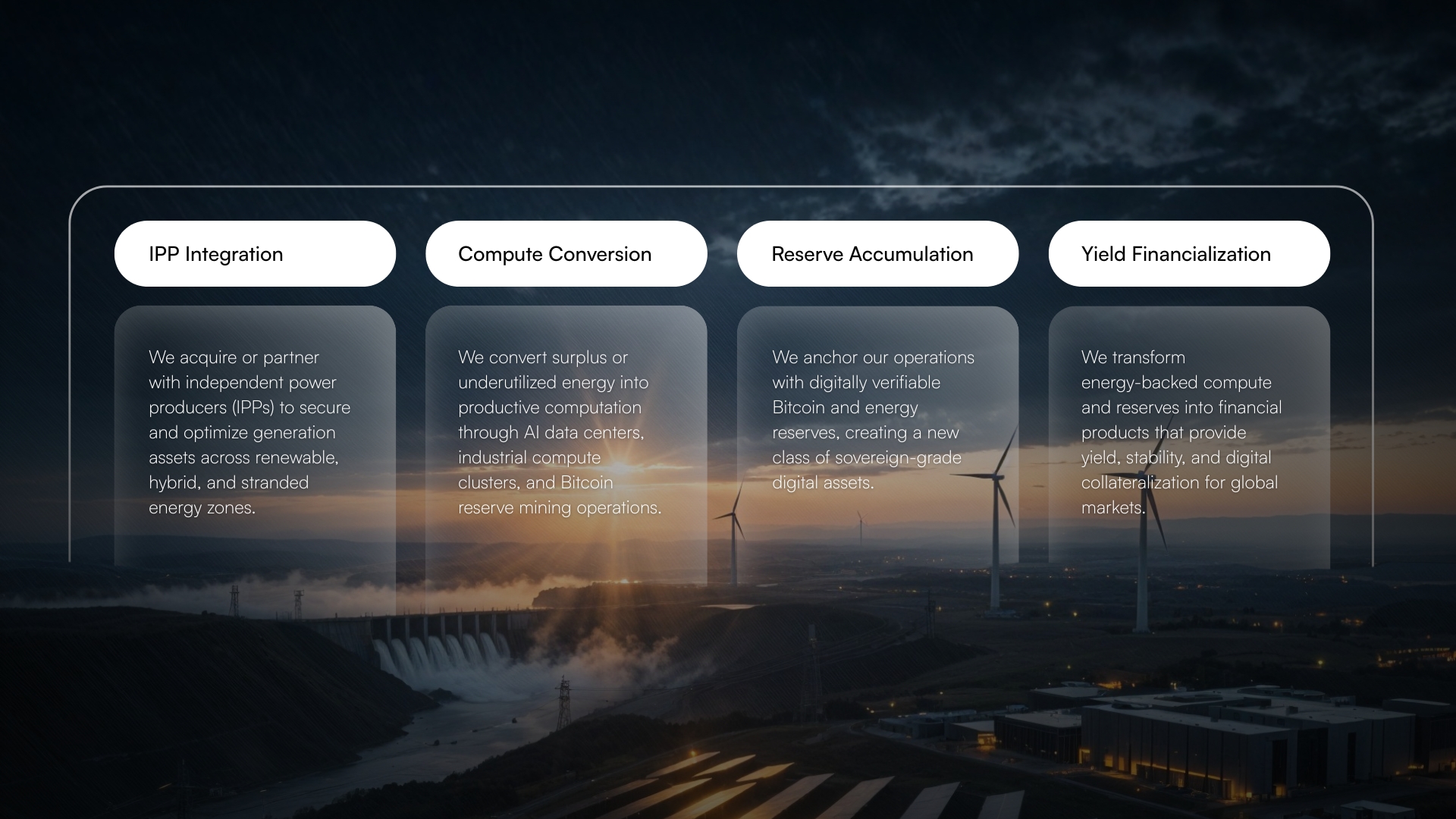

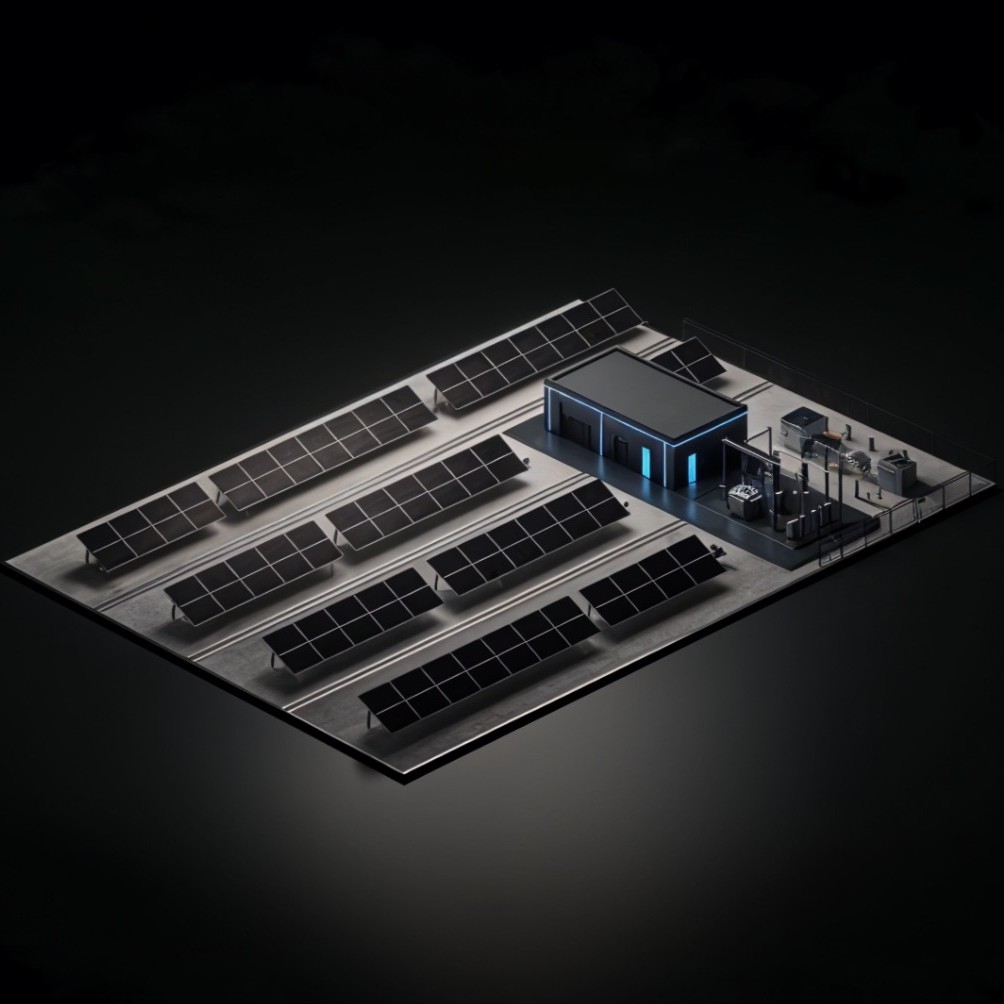

Energy Infrastructure Platform

DERINC envisions a world where power plants

do more than generate electricity —

they generate digital monetary reserves that

strengthen sovereign balance sheets, fuel

AI infrastructure, and hedge against the

decline of fiat-based systems.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)